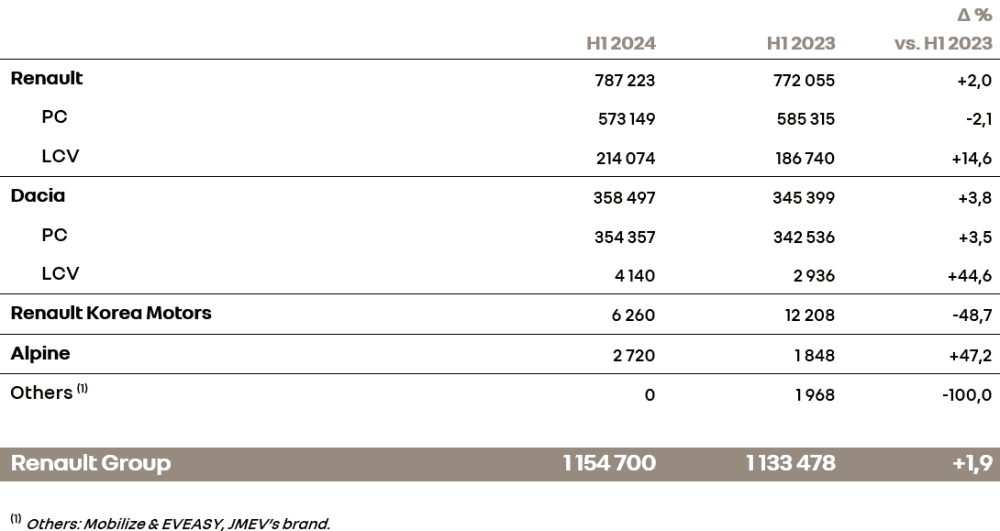

- Thanks to a winning strategy in Europe[1] (+6.7%), Renault Group continues to record an increase in its overall sales in the first half of the year (+1.9%) to reach 1,154,700 vehicles sold.

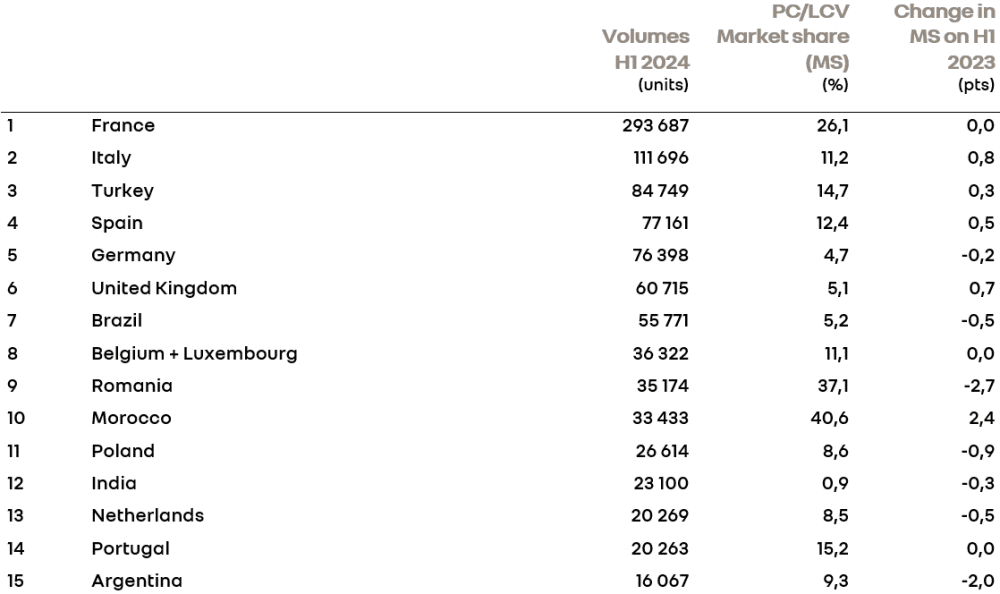

- In Europe, the Group consolidated its third place, selling 847,623 vehicles, an increase of 6.7% in a market that grew by 5.5%.

- The Renault brand is outperforming the market with 535,238 vehicles sold, a rise of 8.2% in a market that grew by 5.5%, third brand in Europe and number one in France (PC+LCV). The growth in passenger cars is based on the very strong performance of full hybrid E-Tech engines (+45% vs. H1 2023). In the light commercial vehicle market, Renault is once again the leader[2] with 171,202 sales (+19.2% vs. H1 2023).

- The Dacia brand sold 309,816 vehicles, a rise of 4.0% on H1 2023. It continues to rank among the top 10 best-selling brands in Europe. Sandero is the best-selling car across all channels.

- The Alpine brand reported 2,569 registrations in first-half 2024, an increase of 47.7% on H1 2023, driven by the success of its extended range with A110 R Turini.

- A proven commercial policy : virtuous mix and sales channels.

- Retail sales accounted for almost 62% of the total number of vehicles sold in the Group’s five main European countries[3], more than 20 points above the market average. The Group has four vehicles[4] in the top 10 retail sales rankings in Europe.

- In the C segment and above, in particular C-SUV and D-SUV (+10%), the Renault brand is accelerating, driven primarily by Austral and Espace E-Tech full hybrid, which high-trim versions are well-appreciated by the customers.

- Electrified vehicles accounted for 29.6% of Renault Group sales in Europe (+4.3 points vs 2023). This performance was driven in particular by the success of the hybrid powertrains, whose sales strongly increased (+59.6% compared to first-half 2023).

- Nearly one in every two passenger cars sold by the Renault brand is electrified thanks to the strong success of its hybrid engines. Renault is Europe’s number two brand in the hybrid passenger car rankings, with Clio, Austral and Captur in the top 10.

- All-electric vehicles accounted for almost 12% of Renault brand sales and will continue to grow in the second half of the year with the launch of Scenic E-Tech electric and Renault 5 E-Tech electric.

- Nearly 10% of Dacia brand sales concern electrified vehicles, driven in particular by the success of Jogger Hybrid 140.

- Alpine has launched its electric offensive with the reveal of A290, its first all-electric hot hatch, on 13 June 2024. Orders are scheduled to open this summer.

- The Group’s order book in Europe represents 2.6 months of forecast sales at the end of June 2024.

- With 10 new commercial launches[5] in 2024, Renault Group pursues its electrification, as well as its expansion into international markets.

Renault brand

The world’s best-selling French car brand

The Renault brand reported a 2.0% increase in sales (787,223 vehicles) in first-half of 2024 compared with the same period in 2023, thanks to its success in Europe, where sales rose by 8.2% (535,238 vehicles). Outperforming a market that grew by 5.5%, the brand consolidated its position as Europe’s third-ranking PC+LCV brand, primarily on the back of results in Spain (+12.7%), Italy (+18.4%) and the United Kingdom (+32.7%).

In its home market of France, Renault consolidated its leading position with 214,881 vehicles sold, an increase of 8% on the overall PC+LCV market. Nearly one in every five vehicles sold in France is a Renault.

Outside Europe, the brand is also making progress in Turkey (10.8%), Brazil (5.3%) and Morocco (1.5%). The first few months of the year saw the roll-out of the “International Game Plan 2027”. Renault is relaunching the brand in South Korea with Grand Koleos, while Kardian is off to a good start in Brazil with more than 5,200 registrations. This vehicle has also been very well received in Mexico and will be launched in Morocco in the second half of the year. In Turkey, the brand recently presented Renault Duster, which will be launched in the second half of the year for international markets.

A value-oriented sales policy: one in every two sales to retail customers in Europe, combined with an acceleration on C segment and above

In its five main European countries, the Renault brand makes one in every two sales to retail customers, a high value-creating market. Clio and Captur are among the top 10 in the retail sales rankings.

Renault is also stepping up efforts in Europe to reconquer the C segment and above especially C-SUV and D‑SUV (+10%), with Austral, Espace E-Tech full hybrid and Rafale, particularly the high-trim versions, which account for the bulk of sales. 55% of Austral sales and 72% of Espace E-Tech full hybrid sales concern the Iconic or Esprit Alpine versions.

Europe’s No. 1 LCV brand

The brand is consolidating its leadership in the LCV market[6] with 171,202 vehicles sold, an increase of 19.2% on H1 2023, in a market that grew by 12.9%. This momentum is driven by the success of flagship vehicles, Kangoo and Express (+30.7% vs H1 2023), as well as Master (+16.0% vs H1 2023), all leaders in their segments. At the same time, Trafic (+22.5% vs Y-1), is now the third best-selling vehicle in its segment.

Relevant technological choices and a two-pronged electrification strategy

Nearly one in every two vehicles sold by Renault is electrified. The brand is continuing its electrification offensive with a two-pronged strategy balancing a complete electric vehicle range with a full hybrid range.

Renault is Europe’s number two brand for hybrids, accounting for more than one in three sales, with an impressive sales increase (almost +45% compared with H1 2023). Clio, Austral and Captur rank among the top 10 best-selling hybrids.

All-electric vehicles account for almost 12% of Renault brand sales and will continue to grow with Scenic E-Tech electric and Renault 5 E-Tech electric. Megane E-Tech electric, launched in mid-2022, ranks among the top 3 in its class in Europe.

2024: Numerous market launches for the Renault brand

With seven new vehicles planned, 2024 is a year rich in commercial launches for Renault. The brand is having a promising first half of the year while waiting for the commercial launches of Symbioz, Master and Renault 5 E‑Tech electric in Europe. Internationally, the brand will continue to implement its “International Game Plan” with the market launches of Renault Duster and Grand Koleos, while Kardian will be launched on new markets.

Dacia brand

Continued progress

Dacia sales rose by 3.8% in the first half of the year, with 358,497 registrations. In Europe, Dacia sold 309,816 vehicles, an increase of 4.0% PC+LCV. The brand is still ranked ninth in the PC market and remains in the European top 10 for PC+LCV sales.

Results driven by a strong new brand identity

Driven by a strong new brand identity, Dacia is consolidating its position on the European retail sales podium, the brand’s core customer base, with four pillar models and conquest and loyalty rates at the highest level on the market.

Global sales of Dacia Sandero totalled 164,789 units, up 18.5% on first-half 2023. Best-selling retail vehicle since 2017, Sandero is also the best-selling model in Europe across all customer channels in first-half 2024.

With 113,783 units sold worldwide, Dacia Duster (including the second generation and recently launched third generation) sales grew by 1.7% compared with first-half 2023. It maintains its position on the podium of SUV retail sales in Europe.

Dacia Jogger recorded 50,841 units sold worldwide, up 0.7% on first-half 2023. It is Europe’s best-selling non-SUV C-segment vehicle for retail sales.

Sales of Dacia Spring are falling as a result of changes in government support and the vehicle’s product cycle. Nevertheless, in first-half 2024, Spring ranked fifth in retail sales of small electric vehicles (A and B segments) in Europe.

Renewal of the range

New Dacia Duster, available to order since mid-March 2024, has been in showrooms since June 2024. It was very well received and has already been awarded numerous times in various markets.

All-electric New Spring is opened to orders since April 2024 for mainland Europe and since June 2024 for the UK. It will arrive in the showrooms in autumn 2024.

In second-half 2024, the brand will present Bigster, its future C-segment SUV, scheduled to arrive in the dealerships in first-half 2025.

Alpine brand

Brand performance

Alpine reported 2,720 registrations, a new record, and an increase of 47.2% on first-half 2023, driven in particular by France (+58.9%), Germany (+45.9%), the UK (+27.2%) and Belgium (+29.5%).

Start of the electric offensive:

In June, Alpine began its electric offensive with the presentation of A290, the brand’s sporty electric 5-seater hot hatch, at the Le Mans 24 Hour event. Orders are scheduled to open this summer.

A faster pace of international deployment:

Internationally, first-half 2024 saw the roll-out of Alpine in Turkey and the opening in Barcelona of the first Atelier Alpine, an experiential concept store soon to open in London and Paris. By the end of 2024, the brand plans to open new Alpine stores in the Netherlands, Hungary and Sweden, as well as in France (including in Guadeloupe).

RENAULT GROUP WORLDWIDE SALES BY BRANDS

RENAULT GROUP’S TOP 15 MARKETS

[1] Scope: ACEA Europe

[2] Excluding pick-up trucks

[3] France, Italy, Germany, Spain, United Kingdom

[4] Sandero, Duster, Clio, Captur

[5] 10 new vehicles launches in 2024 without Renault Duster (outside Europe) and Captur facelift

[6] Excluding pick-ups